Platformnomics: Platforms, Platform Monopolies & How to Fix Them

First version: Dec 2016, updated Feb 2018

Around the world countries have wrestled with the question of how to manage companies like Amazon, Google, Facebook, Uber and AirBnB. Are these new platforms something to be welcomed or something to be stopped? But how we treat platform companies is largely dependent on how we see and understand them.

There is, in fact, nothing especially digital about the underlying economics of these platforms business model. In fact, their economics are very similar to businesses that have been with us for hundreds or even thousands of years: marketplaces.

Marketplaces like our modern digital platforms have a simple economics which is problematic for free market capitalism. Specifically, there is a positive feedback between buyers and sellers: more buyers at a fish market bring more sellers which in turn bring more buyers. This creates a winner-takes-all dynamic and any free competition between marketplaces ultimately tends towards "one" – a single dominant player. This, in turn, means monopoly if that one platform/marketplace is exclusively owned and controlled.

Monopoly is not inevitable though: we can have open platforms – just as we have free and open markets. To do this requires us to open the digital infrastructure and, where appropriate, to open the order book too.

Note: we'll use the term platform and marketplace interchangeably going forward. Today, "platform" is the more common term in the digital world and in economics ("two-sided platforms" etc). However, here we often prefer "marketplace" because it connects this with something both familiar and ancient.

Market Day in Stockport in 1910s. Link

Table of Contents

- Introduction

- Executive Summary

- 1. Uber-like companies are marketplace or platform companies

- 2. Platforms tend to one because of positive feedback between buyers and sellers

- 3. Platforms tend to monopoly (unless made open)

- 4. These platforms are not "contestable"

- 5. Thus, the monopoly platform owner has a lot of power

- 6. That power is inevitably used to the detriment of buyers and consumers

- 7. The solution is to open the platform

- 8. Remuneration rights can pay for open

- 9. Being pro-active is essential

- Visual Summary of the Thesis

- Part I: Of Marketplaces

- Part II: Open and Monopoly Marketplaces

- Part III: What is to Be Done

- Conclusion

- Appendix: Correcting the Misnomer of the Sharing Economy

Introduction

All round the world countries have struggled with how to deal with Uber, AirBnB and similar companies. Are these new apps and their associated marketplaces something to be welcomed or something to be stopped? Practically, officials and regulators face tough choices about how to handle their arrival. These choices range from outright bans to enthusiastic endorsement.

How we treat Uber-like companies is largely dependent on how we see them. Are they disruptive innovations bringing efficiency and a better deal for consumers through freer, more efficient markets? Or are they predatory platforms, using their massive warchests to undermine existing social frameworks, exploit a casual workforce and create a monopoly that will ultimately exploit consumers and workers alike?

I've personally encountered many of these debates. In Estonia in September 2016 I talked with parliamentarians just before they introduced a special "Uber Law". In Denmark two months later I found that Uber was officially banned – but still advertising on the Google maps on my phone. In February 2017 in Taipei I met the Digital Minister on the day that Uber became officially illegal – after two years of intense negotiating and a much heralded compromise agreement (that fell apart).

In conversation after conversation about Uber what struck me was that policy-makers lacked a good framework for thinking about these types of companies. More than that, there was a widespread belief that Uber-like companies were something different and new. That they were, in some way, part of a wave of digital innovation, perhaps even drivers of a new type of economy – the "sharing" economy.

This is a mistake – and a dangerous one.

There is nothing especially digital about the underlying economics of Uber's business model. In fact, the economics of Uber, and the associated regulatory issues, are very similar to businesses that have been with us for hundreds or even thousands of years: marketplaces / platforms.

For example, Billingsgate in London was for several hundred years the home of London's fish market – and one of the biggest such markets in the world. Or back in the 13th century, Champagne became the site of a major medieval fairs where merchants all over Europe would converge each spring to buy and sell to each other. The economics of Billingsgate fish market or the Champagne fairs are the same as Uber today.

Billingsgate Fish Market in London, 1876. Link

For many, this fact is masked by the association of Uber with digital technologies like smartphones and the Internet. Whilst the advent of smartphones and the Internet have played a critical role in the rise of Uber, this is, in fact, largely irrelevant to the economic analysis of Uber and how we should handle it.

At the same time, it is important to understand that digital technologies are creating ever more "marketplace" industries like Uber. Thus, it is ever more important to understand the real economics and the real lessons of this "Uberization".

Executive Summary

1. Uber-like companies are marketplace or platform companies

Stripped to their essence Uber, AirBnB resemble a very old economic structure: the marketplace. Marketplaces are where buyers and sellers come together to exchange. On Uber this is riders and drivers. On AirBnB owners and renters. Marketplaces have existed for thousands of years, practically since civilization first began.

More broadly, we have platforms. This includes companies like Facebook, Google, Microsoft and eBay. Facebook is a platform mediating between users – and advertisers. Google is a platform mediating between users and content – and advertisers. Microsoft's Windows is an operating system platform mediating between apps and users.

Strictly platforms as broader than marketplaces. For example, an operating system or social network is a platform but not, obviously, a marketplace. However, many of the same ideas apply and so the distinction does not matter much.

2. Platforms tend to one because of positive feedback between buyers and sellers

Like a snowball down a mountain, platforms once past a critical threshold can grow rapidly thanks to positive feedback between buyers and sellers: more buyers means more sellers and vice versa for two reasons:

- Liquidity: a larger platform means more liquidity. Concretely, there are more sellers make it more likely a buyer can find a seller (or has more seller competition meaning lower prices). Conversely, for sellers: they are more likely to have buyers, and many of them. In real life, lots of drivers on Uber mean you can find a ride on Uber in your area in the next 5m, or on AirBnB you can rent an apartment on the dates you want, on Facebook it means finding more friends etc.

- Diversity: a bigger platform will have a range of products thereby matching a wider set of tastes – a fish market will have many types of fish, a stock market many types of stock, a rental market many kinds of apartments.

Furthermore, buyers and sellers don't want to have to go to many different platforms ("multi-homing" is a pain). Combined with the positive feedback effects of liquidity and diversity, this creates a strong pressure for there to be just one platform.1

Thus, over time one platform will come to dominate – "platforms tend to one".

3. Platforms tend to monopoly (unless made open)

As just stated, because of these snowball economics, "platforms tend to one".

You don't have ten fish markets in a town, you have one. You don't have fifty stock exchanges, you have one.

If the platform is "closed" – exclusively owned and controlled by one entity – then with dominance ccomes monopoly. This is not inevitable: an "open" platform is possible where anyone can participate on fair and equitable terms. For example, the Internet and the World Wide Web are concrete and living examples of the possibility and power of open platforms. However, exclusive ownership is common so it is fair to say, absent special effort, platforms tend to monopoly.

Note: why is exclusive, proprietary ownership so common? In short, for two reasons: first, because coordination on the investment to create an open platform is harder than for investors to back a proprietary platform. Second, because whilst the total value generated by an open platform is higher than a proprietary one, the value accruing to its owner/investors is lower.

Note: there can be substantial competition to become the monopolist. There may also be some competition between regional monopolies when there is enough geographic or preference diversity: if you live in Scotland you won't go to London to buy your fish so several local fish markets can exist (with limited competition between them at the fringes).*

4. These platforms are not "contestable"

It is hard and expensive to create a new platform, especially if that involves competing against an existing one.

Why? Buyers are numerous and independent coordination between them is very hard. The same is true for sellers, though to a lesser extent because sellers are usually less numerous and diverse than buyers (fifty fishmongers at a market might supply thousands of fish-buyers).

This makes coordinated action very hard and coordinated action is exactly what is needed for switching to a different competing platform. Concretely, as a buyer I don't want to head over to the new fish market only to discover all the fish sellers are still at the old one. Similarly, no fish-seller wants to risk moving their stall to the new market until they know the buyers will be there. This is a chicken and egg problem with thousands and chickens and eggs who all need to act simultaneously!

5. Thus, the monopoly platform owner has a lot of power

Thus, the owner of platform has a lot of power – once the platform is established. Of course, at an early stage, platform industries may be highly dynamic and competitive as firms fight to get critical mass and dominate the market. This can mislead policy-makers into believing the market is competitive which in turn prevents them from acting at that crucial early stage when it would be relatively easy to put in place long-term pro-competitive policies e.g. establishing a neutral exchange, or regulated platform access rates. However, once entrenched a platform monopoly is very powerful and resilient.

6. That power is inevitably used to the detriment of buyers and consumers

When an organization has a lot of power it will use it to its advantage. In the case of the platform, the obvious thing is for the owner to start aggressively charging the users of the platform for access. Depending exactly on how the platform works it can charge buyers, sellers or both. Often charging sellers is preferred because they are easier to identify, contract with and track and they have a larger and better sense of the value of the platform per entity. Thus, it is Uber's drivers who get charged the 20-25% fee by Uber – of course, this fee, gets passed on to consumers but they don't directly see it.

Another major negative impact of monopoly power is what we term the Kronos Effect. This is less visible but potentially even more significant. It refers to the fact that platform owners have strong incentives to distort innovation and innovation opportunites around their platform in order to preserve their power. For example, suppose a desktop oriented social network platform happens to notice the rise of a mobile photo sharing app. Whilst the photo sharing app seems quite different the social network platform can see how it will grow more social and becoming a potential threat to their platform monopoly. Suppose as a result they take action to take over the photo app and integrate it into their main product. Whilst the app may still exist the potential innovation it may have provided is now largely lost. Precisely because that potential is unknown it is hard to estimate. However, the examples we do have from history e.g. the efforts by telcos to obstruct competitors and the early internet suggest that potential costs could be huge.

Note: a side benefit of charging sellers is that it makes the fees largely hidden to buyers which is good both for PR and politically: if buyers got upset they might start pushing politicians to regulate the platform. For example, most people think that Google is just wonderful because it provides them with a valuable service for "free". They don't see, of course, that they do pay – just indirectly through the sellers (advertisers and content providers) who have to pay Google or supply Google with free content.

7. The solution is to open the platform

The solution to platform monopolies is to make the platform open: accessible to all buyers and sellers on equitable and non-discriminatory terms. This involves two steps:

- Opening the software, protocols and non-personal data that power the platform.

- Opening the "order book": Universal, equitable access to the "order book" with pricing set to cover the cost of maintenance. Preferably this would involve the order book being run and managed by an independent third-party with governance in place to ensure a transparent and equitable pricing and access policy. However, it can also involve regulation of the monopolist to force them to "open" the order book on reasonable terms (e.g. API access to Facebook friends, regulating Amazon's listing charges etc).

It is worth emphasizing that competition between proprietary, closed, platforms is not sufficient. Openness is essential.

8. Remuneration rights can pay for open

It costs money to create the software, protocols and (non-personal) data that power a platform. Traditionally, entrepreneurs and investors fund the creation of these based on the hope of becoming a platform monopolist and making it rich. Without the monopoly why would they invest? One option would be farsighted funding by the state – as with the Internet. However, this is problematic: how can the state know exactly which entrepreneurs should be backed with what ideas?

Instead, we can use remuneration rights. These provide a free-market-like but open-compatible way to fund innovators. In essence, remuneration rights combine a common subscription payment from citizens organized by the government combined with a market-based payment of those monies to innovators based on whose innovations get used. You can read more about these ideas in my book The Open Revolution.

Finally, actually running the platform itself costs money even if the protocols and software are free and open to use – you still need data centers and sysadmins to keep the servers running. With the software and protocols being free, service providers can freely compete and users will have a choice of who they use – just as we choose today between different "Internet Service Providers" who operate the Internet and provide us with access to it.

9. Being pro-active is essential

Policymakers and stakeholders need to take a pro-active approach. It is far easier to shape a platform towards openness early in its development than it is to handle an entrenched and powerful monopolist platform once in place.

Visual Summary of the Thesis

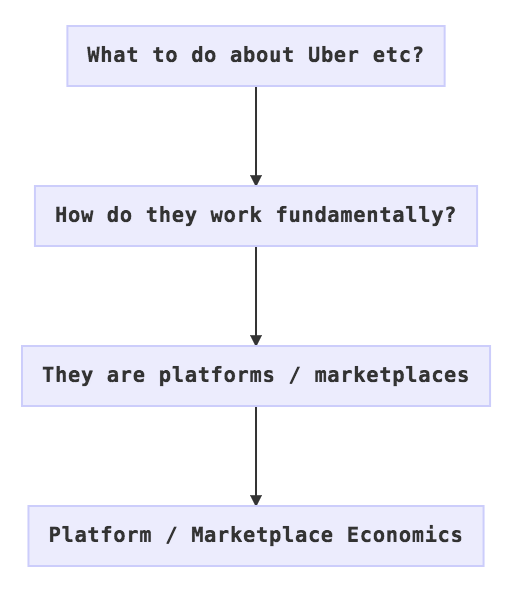

Motivation: How to Understand Uber

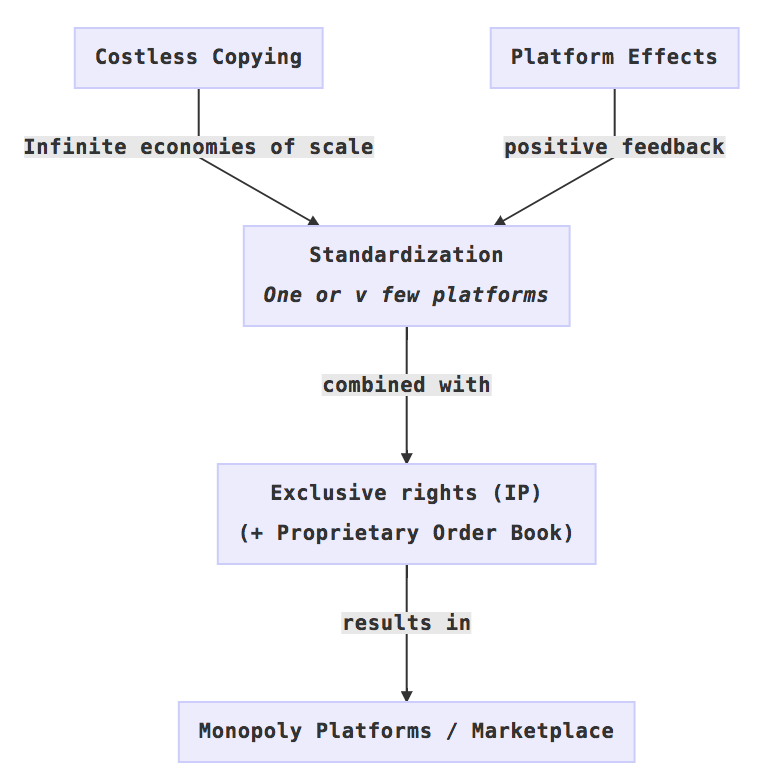

Platforms + Exclusive Rights = Monopoly

Platform effects combined with exclusive monopoly rights (copyright and patents) and a proprietary order book leads to monopoly. This is a problem because a monopoly is bad for consumers, providers and long-term innovation.

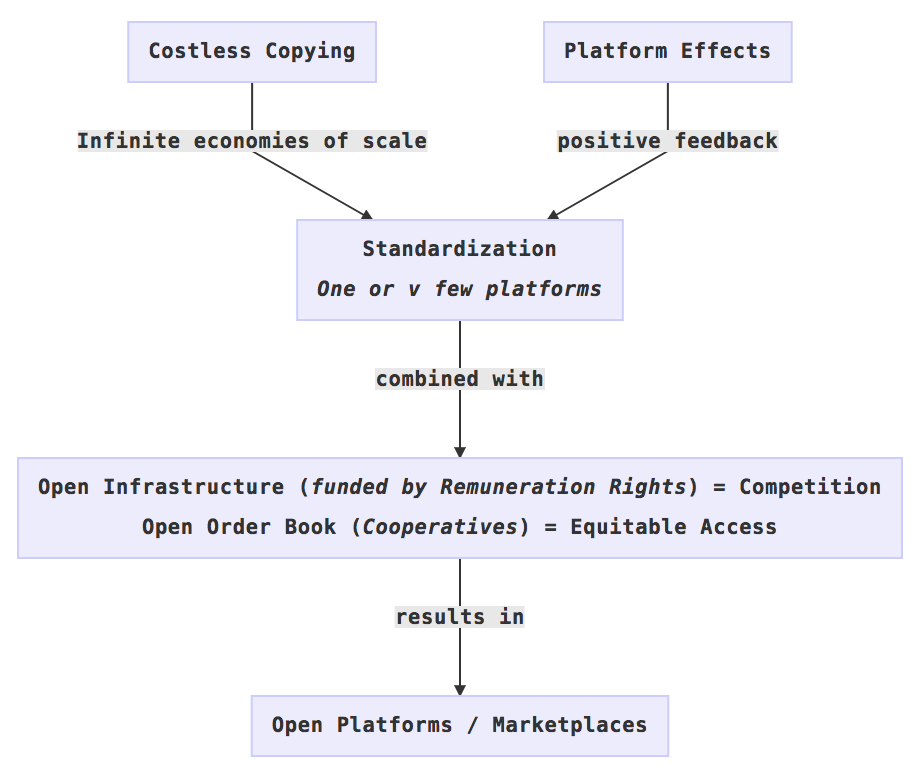

Open Platforms are Possible

A solution: make the platform open by:

- Opening up the platform infrastructure such as software, protocols etc (and having an open-compatible funding mechanisms to pay for their creation)

- Opening up the order book (the "bid-offer" database): that is, ensuring universal access on fair and equitable terms (one option being to have it cooperatively owned and regulated).

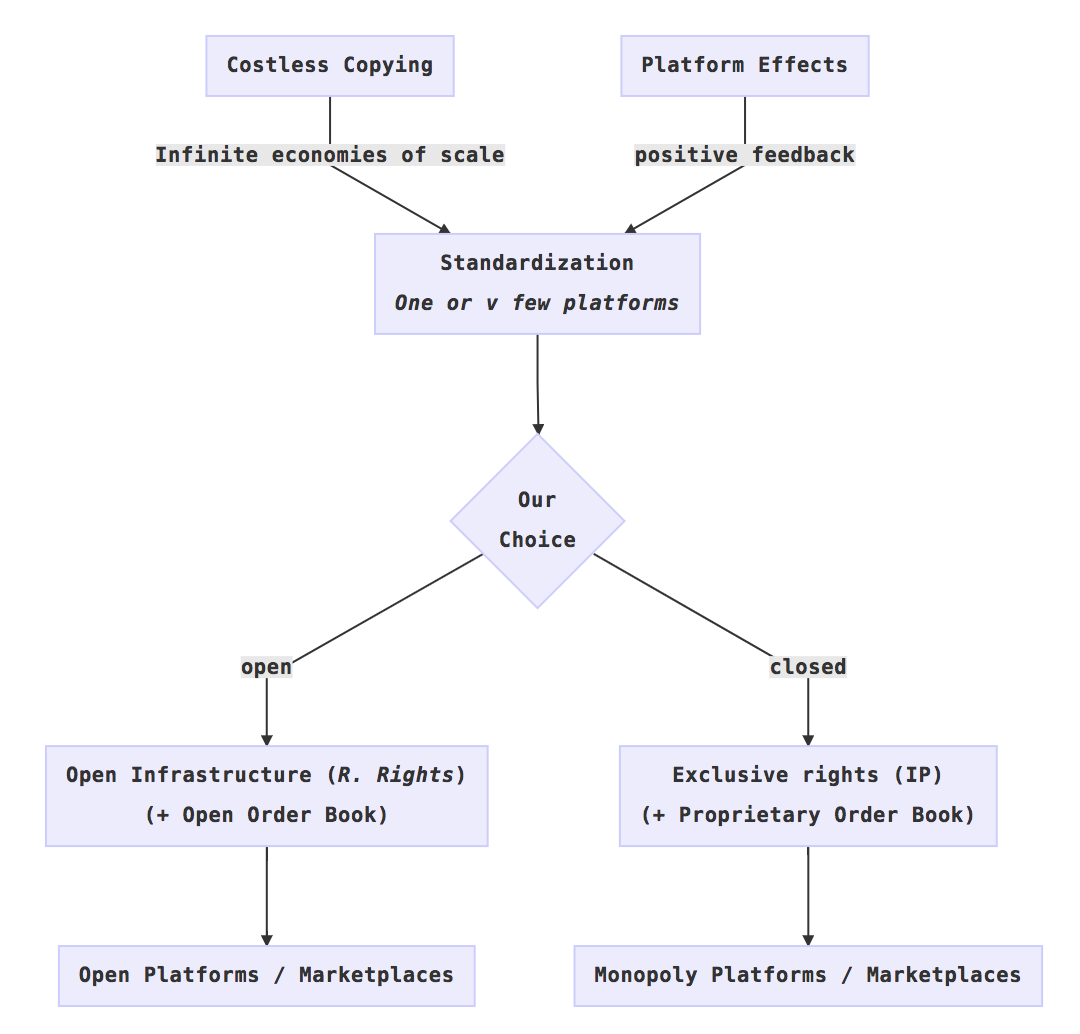

We Have a Choice

Summary: we can have monopoly platforms or open ones – it's our choice. Open platforms can be achieved by replacing monopoly rights with open-compatible remuneration rights as a method of funding platform infrastructure, and replacing a proprietary order book with an open (where an order book exists).

Part I: Of Marketplaces

Stripped to their essence Uber, AirBnB and the like resemble a very old economic structure: the marketplace.2 Marketplaces have existed for thousands of years, practically since civilization first began. Marketplaces are where buyers and sellers come together to exchange. At a fish market you buy fish, at a stock market you buy stocks etc.

Rot Fai Train Night Market, Thailand (Credit)

But what distinguishes a marketplace from anywhere where we exchange? For example, suppose I walk over to the farm of my neighbour Pete and he sells me some carrots. We would not describe his farmyard as a marketplace.

However, if Pete started organizing Saturdays where his neighbour Joe sells eggs, and his friend Charlotte sells milk and hundreds of us start heading over to Pete's place to buy from them then it would become a marketplace.

So markets need some degree of scale. In fact, the scale and the associated diversity and volume are part of the essential benefit of a marketplace. I might be willing to go to Pete's place for a few carrots but not many other people will. However, if you can get vegetables, eggs and milk all at the same time it would be worth it. Economists would call this an economy of "scope".

In addition there is the economy of scale: if just Pete is selling carrots he may run out after the first set of customers leaving a lot of frustrated buyers. But if other suppliers are there you're pretty certain to get served – and find it worthwhile to make the journey. And the benefits of scale and scope don't just benefit buyers. On the seller side it is true too: a bigger marketplace means more buyers to buy your goods.

These benefits of size create a positive feedback effect. More buyers drive more sellers – there are more people to sell too now, and more sellers drive more buyers because of variety and reliability. This creates a cycle of growth. Marketplaces are therefore a bit like a snowball rolling down a mountain: once at a certain size the snowball will just keep rolling, growing bigger and bigger as it goes. It may even become an avalanche and absorb all the snow on the mountain – Pete's marketplace is now so big that everyone in the entire region goes there.

And like a snowball, a marketplace will often have some kind of natural limit. At a certain point it is not worth a buyer travelling to Pete's market because it is too time consuming. Similarly, at some point all the nearby farmers are already at Pete's place – and it is not worth more distant ones loading up their trailers and making the journey.

Aside: a bigger marketplace also means more competition (both for buyers and sellers!). However, the scale and scope effects outweigh that disadvantage. Plus, outside the marketplace, only one party can have an advantage: if the buyer has the power then the seller loses out – they can only sell to that one buyer. This gives the seller the incentive to join a marketplace, and vice-versa.

Originally, marketplaces were physical locations where you exchanged real things: carrots or corn. But at some point people started to meet to exchange not the actual thing itself but "ownership" of that thing and we got commodity markets. And then people traded ownership of other things like companies – the stock market – or loans – the bond market.

The interesting thing about these markets is that since there were no physical goods – no carrots or corn – directly involved, markets could get bigger because you didn't have the limit imposed by the cost of transporting goods to the marketplace. Instead, the limit was just whether you could travel to the market – or once we invented telegraphs the cost of sending instructions by telegraph.

So markets gradually grew in scale. Then with the internet and mobile phones "distance" shrank again. In addition, the economies of scale in operating the marketplace – in writing software, running servers, developing a brand – drove some convergence even across markets: in the virtual, digital world the marketplace itself is no longer a town square or even the stock exchange floor but just some code in cyberspace. This means that even though London and New York are different markets for taxi rides there is are some economies in scope in running both markets. There are also economies of scale in that the kind of people who book a lot of taxi rides also tend to travel internationally and once they have Uber on their phone in New York it makes it more likely they will try it when they land in London.

In short, digital technology with its infinite economies of scale (one piece of software can be used to run one or a million servers) and its globalization of consumption (we all have smartphones) means that digital marketplaces have an unprecedented scale and scope.

Part II: Open and Monopoly Marketplaces

So far we've established that the positive feedback economics of marketplaces mean that there tends to be one (or very few) marketplaces in a given sector and region – whether it is a marketplace for taxis, house rentals, or second-hand furniture.

This is something of a law of nature. The huge economies of scale and scope mean we won't have lots of marketplaces, we'll have one.

The next question to ask how is what marketplace owned and operated. In particular having one marketplace doesn't mean its monopolized, that is, controlled by one proprietary owner. For example, many traditional marketplaces are operated cooperatively or by the state with equitable, transparent access is provided to all. To describe such marketplaces we term them "open" to contrast them with monopoly marketplaces that are "closed" – closed because access to the marketplace is controlled by the monopolist.

To illustrate the options let's go back to Pete and his farmers market. One option is that Pete owns the market – it's at his farm after all. He then can charge both other farmers (sellers) and/or consumers (buyers) to come to the market. At the start this power to charge might not be very strong: if he asks for too much other farmers may not want to come or, worse, want to start a competing marketplace of their own. But over time, as his market gets established and dominant in the region that power will be very significant. It would be hard for another marketplace to establish itself once consumers are used to Pete's marketplace.

Thus, over time Pete's ownership of the marketplace will turn into a monopoly with very substantial power. Most obviously pricing power in the form of the ability to set prices for farmers and/or consumers. But also more subtly and, perhaps, more significantly, the ability to shape the evolution of the marketplace, and, through that the farming in the region.

For example, Pete may use his power to control who comes to the market to include or exclude certain types of farmer. He may decide that he does not like organic farmers because he they make less money or, more nefariously, that they build direct connections with consumers which will undermine his marketplace monopoly in the long run.

Alternatives to monopoly are possible. Pete could decide from the outset that he wants to have an "open" marketplace. When it starts up he could promise other farmers – and consumers – that his marketplace won't charge and won't exercise control over who can participate. Or, more realistically and accurately, that a) charges will be transparent and only levied to cover the cost of operating the marketplace (i.e. no monopoly pricing); and b) that rules of participation will be transparent, equitable and set through some reasonable form of governance.

Having a proper structure governance is important because it allows you do deal with problems like excluding violent troublemakers or banning fraudulent traders whilst guarding against the risk that control is not subverted, for example to carry out vendettas or advantage some group over another (e.g. only Pete's friends can join etc).

In overall terms the open marketplace is far better than the monopoly marketplace. Both farmers and consumers are much better off because the value generated by the marketplace is larger and more equitably distributed. The value is larger because:

- More people participate. Monopoly pricing reduces participation because the monopolist's fees discourage some farmers and/or some consumers from participating.

- More innovation: participation is open to all means ideas can flow freely maximizing the chance of improvements. For example, there's not risk that organic farmers are excluded because of Pete's fears that they'll undermine his monopoly position.

In addition there is also an effect on equity because resources are more fairly distributed. In the open case, farmers as a whole (including Pete) are better off. However, Pete as an individual is less well-off than he would be under monopoly. The value Pete derived from the marketplace under monopoly still exists but part of it has been redistributed to other farmers and, possibly, to consumers.

This explains why monopoly marketplaces are common even though open marketplaces are better for society: the owner of a monopoly marketplace can become very wealthy indeed.

And it may not even be that Pete has any monopolistic ambitions. Suppose Pete faces competition from Joe to establish the local marketplace for farmers. To compete with Joe, Pete needs to invest heavily in advertising and in encouraging farmers and consumers to come to his marketplace, for example by offering free transport to farmers and special discounts to first-time consumers.3 Meanwhile, Joe is doing the same in an escalating war of attrition.

In these circumstances Pete will have to invest a lot of capital to compete. If he makes his marketplace open he may struggle to recoup his investment – when later on he needs the marketplace to set fees to pay him back will people believe how much he had to spend? And what about if Pete needs to borrow money from a bank or take investment from a venture capitalist. These third party investors are going to be even more concerned about having a reliable business model that ensures they get a good return. They will be much happier with the pricing power of a monopolist to guarantee them that return.

Apart from monopoly and openness there is one other common option: the farmers can club together to own the marketplace.4 This clubbing together may be informal or it may take on a more formal structure as a cooperative. Real world cases that resemble this include taxi services and many stock exchanges. In the case of taxis, in many cities around the world taxi owners control the marketplace via their control of the taxi regulating agency (this agency may also reflect consumer interests to an extent). The taxi agency will then control who can access the market from the sellers side by regulating access to taxi permits. If the taxi-owners are dominant the usual result will be an under-supply of taxis since this drives up the returns to holders of existing taxi permits as each taxi is more profitable.

This is just the same as if Pete limited the number of farmers at the market: this would be bad for consumers (and the farmers who didn't get to come) but good for the farmers who are invited as they get to sell more with less competition. The other example is stock-exchanges which have often ended up owned by their member share-brokers. The member brokers act as a club limiting access and requiring new entrants to "buy a seat on the exchange"5.

The sellers' club model is reasonably common especially in the long run. This is because sellers often become aware of the risks to them of having their marketplace owned by a dominant monopolist. However, the club model has many of the drawbacks of the monopolist one. Sellers as a group will raise prices for consumers above optimal levels. For example, stock brokers will overcharge for commissions, taxis will either set rates too high or limit supply to increase their occupancy resulting in increased wait time for consumers. As evidence for this consider that New York City taxi permits ("taxi medallions") reached a price of over $1m in 2014 prior to the advent of competition from new rideshare services. In addition, the sellers club rapidly becomes a self-perpetuating in-group favouring existing members over new ones and resisting any innovation that would disrupt their comfortable and well-remunerated situation. Unfortunately, as a small, highly motivated interest group sellers often make formidable political lobby groups and once entrenched persist for a long time.

All of the above is well illustrated by the case of Uber (and other ride-sharing companies). Uber is making a play to become a monopolist. To do this it has had to attack the existing taxi services system which in most countries sits somewhere between an open marketplace and the sellers cartel. Uber has spent huge amounts of its money and energy not on technology which is relatively simple but on:

- Political lobbying to overcome the entrenched power of taxi cartels

- Efforts to get to a critical mass of liquidity and especially seller liquidity by having sufficient drivers on its marketplace. Seller liquidity is absolutely crucial for a taxi service because users care most of all about their ability to get a ride promptly and reliably.

In the short-run Uber is beneficial to consumers (and probably society as a whole) because it shakes up existing taxi services (some of which have become quite cartelized). It provides consumers with a highly liquid ride marketplace that is often cheaper than the old option. And all of this has been subsidized for us with billions of dollars from venture capitalists.

The problem is that Uber and its venture capitalist backers are not doing all of this out of the goodness of their hearts. They need payback and the only real way to generate the returns they need is by being the monopolist. Thus, in the medium to long-run dominance by Uber – or anyone else – is a real issue as they will use their monopoly power to exploit drivers and users, and, perhaps most importantly, to stunt and distort innovation in order to preserve their monopoly power.

Part III: What is to Be Done

What is solution to the problem of these growing marketplace monopolies like Uber and AirBnB? (As well as old ones like eBay)?

The solution is to make these marketplaces open. To explain what exactly should be open and how it should be open we need to distinguish exactly what a digital marketplace consists of. The essence of the digital marketplace is the "order book" – the list of offers by sellers and requests by buyers together with the actual transactions that have happened. In the case of a ride service like Uber this would be the list of drivers and their availability in realtime together with the list of users and their current requests. For a space rental service like AirBnB this would be a list of spaces to rent, their current availability together with a list of users seeking rentals and their current requests for rentals.

Further we can distinguish two parts to the order book:

- The software and protocols that power the order book

- The data in the order book

Opening a marketplace platform therefore means:

- The software, protocols and non-personal data that power the platform must be made open software and open data, that is, freely available for anyone to use, build on and share.

- The database behind the order book must be made available to all parties on a non-discriminatory basis with access fees set to cover costs of operation and development including costs of developing software and protocols (i.e. §the previous item). To provide this and sustain it over the long-run some minimal governance system should be put in place.

In analogy with Pete's farmers market the software and protocols would be the trucks and cars that farmers and consumers use to get to the marketplace along with the tables and stalls and actual courtyard space where the trading takes place. Pete's marketplace would not be open if you could only visit Pete's marketplace in one special type of truck that is made by Pete's brother. Or, if, once there you could only use a special kind of stall that only Pete supplied. Making these things open means that anyone has the means to join the marketplace and also that anyone has the means to create a market "space": in the digital world Pete's courtyard becomes a virtual space made of software so making that software open provides the ability for anyone to create a market-space.

Opening up the software, protocols and non-personal data ensures everyone can participate technically and also ensures that anyone can create and operate the market-space. However, this is of only limited importance. The fact I can drive to Pete's market means little if he can charge me to get in once I'm there. Similarly, market-space itself is of only limited importance: what really matters is liquidity and a critical mass of buyers and sellers – that farmers Alison and Joe each have a courtyard "space" where a market could take place creates no competition for Pete if his market is already established with lots of buyers and sellers.

Thus, the second, and most crucial aspect of an open marketplace is universal, equitable access to transact in the marketplace: that is, access to the order book database.

The order book database probably cannot be made fully open itself because it will likely contain personal information. For example, in a ride service like Uber you'll have the location of users who want to book rides and the past rides they've booked. In addition, running the order book and executing transactions requires payments to be made. Finally, the order book database is not a static database but a live software service that will need to run reliably 24/7. This will involve ongoing costs to host and manage the database and provide network APIs.

Also this implies that one needs a trusted party to run the order book database. It also suggests having a centralized service.6 There are several ways this could be organized. One option is to have a private company do this and regulate them. Another option would be to have the order book service run by the state. Another would be to have it run as a cooperative overseen by a regulator. Another option would be to engage several competing firms to provide order book hosting services and shard or replicate the order book among them (this may be technically complex though). The key point would be that the order book service is provided a) efficiently at a reasonable cost b) equitably to all parties and c) permits ongoing innovation by third party users. Finally, we need to provide robust and sustainable funding for the order book service and this could be done via access pricing set by an independent regulator.7

Let's work this through in a specific case such as a ride service like Uber. OpenRides our open Uber service would have an API for offering, requesting and booking rides that was open to all third party software developers and even directly to drivers and users if they wanted it. This would allow anyone to build a taxi/ride booking app for users: the app developer could create their own interface and would connect into the OpenRides platform to find rides to display and then to users to book. Meanwhile, other developers could create apps for drivers that allowed them to sign up to OpenRides places ride offers in the order book ("I'm driving now and am located here …").

As this example, makes clear it is important to distinguish the order book from the app that users and drivers actually use. When we think of Uber today most of imagine that app on my phone. And if you are driver you think of the driver app on your phone. But in the background is a big database in a data center together with an order book software application service that consumer and driver app connects to. This is what your app is doing when it displays that message about "searching for rides". And it is this part of Uber, and this part only, that OpenRides needs to provide. The user facing apps can be provided by third parties – many of them. This is a good thing as it allows for competition and innovation in the app space but without success in the app space turning into a monopoly of the whole marketplace.

Thus, in an OpenRides future you might still have Uber on your phone but it would no longer be a monopoly of the marketplace. Any other app developer could create a ride-booking client and compete with Uber – and have access to exactly the same pool of drivers.

Conclusion

In conclusion, marketplaces are growing both in number and size in the digital world because digital technology reduces transaction costs making it easier for buyers and sellers to connect and transact.

Marketplaces have always been with us and their economics is simple: positive feedback mean that marketplaces standardize and we end up with just one (or a very few). Digital technology has, if anything, increased those feedback effects as the costless copying of digital software and data results in extraordinary economies of scale, and digital technologies such as smartphones and data analytics increase economies of scope.

This standardization turns into a monopoly if the marketplace is proprietarily owned and controlled. In the case of digital marketplaces this means that the technology and the order book is proprietary – something ensured by the use of monopoly rights (copyrights and patents) together with simple control of access enforced via contract and monitoring. For example, services such as eBay sue people who scrape sales information from their website and apps like Uber and AirBnB simply refuse access to their API or only do so under very restrictive conditions.

The solution to marketplace monopolies is to make the marketplace open: accessible to all buyers and sellers on equitable and non-discriminatory terms. This involves two parts:

- Opening the software, protocols and non-personal data that power the marketplace.

- Universal, equitable access to the order book database with pricing set to cover the cost of maintenance. Preferably this would involve the order book being run and managed by an independent third-party with governance in place to ensure a transparent and equitable pricing and access policy.

It is worth emphasizing that competition between proprietary, closed, marketplaces is not sufficient. Openness is essential. This is for two reasons.

First, as we have shown above, competition between marketplaces is impossible to sustain in the long-term because of the positive feedback / snowball economics of marketplaces. Second, for marketplaces traditional competition is actually socially inefficient because it reduces liquidity and/or increases costs:

- Liquidity: splitting buyers and sellers across multiple marketplaces reducing the potential for mutually beneficial transactions

- Costs: requiring buyers and sellers to participate in multiple marketplaces is inefficient and costly. For example, imagine a world where I need to install ten separate ride-booking apps on my phone and check them all.

In short, marketplaces thrive on liquidity and competition between marketplaces reduces liquidity.

Finally, the analysis and solution we have set out applies to many of the developing marketplace monopolies we see today including Uber, AirBnB, Amazon, eBay etc. Moreover, policymakers and stakeholders need to take a pro-active approach. It is far easier to shape a marketplace towards openness early in its development than it is to handle an entrenched and powerful monopolist marketplace once in place.

Appendix: Correcting the Misnomer of the Sharing Economy

Uber, AirBnB and similar companies have sometimes been branded as part of the "sharing economy".

The "sharing economy" as a term is fundamentally misleading. Uber and AirBnB are not facilitating sharing any more than any other marketplace is. We don't talk about the bond or stock markets as part of the sharing economy because they facilitate "sharing" of capital between investors and businesses. When eBay arrived we did not talk about a new "sharing economy" that allowed people to "share" their second-hand stuff with people who wanted to buy it. Amazon is not creating a "sharing economy" where businesses "share" goods with consumers (for money!).

Uber drivers are providing rides for money. AirBnB hosts are renting their homes and rooms for money. There is no sharing in the traditional sense of the word. And to appropriate the positive connotations of the term sharing for marketplaces like these is misleading to the point of deception.

It's therefore time to "call time" on the "Sharing Economy" and just refer to these businesses as what they are: (digital) marketplaces.

Footnotes

-

The only reason you get more than one platform is if there is sufficient variation in buyer preferences (plus congestion in the physical world – there's only so many people who can fit in the platform). For example, in the physical world buyers have a preference not to travel too far so you can still have two markets in different towns fifty miles apart. In a virtual world there's no literal distance but there may be "distance" in tastes: some people like Macs enough that Mac managed to retain a (tiny) market share against Windows even when Windows was very dominant because those "Mac" people just really liked some aspect of Macs. Even in this case though the platforms will be lop-sided with usually one platform with the great majority of users. ↩

-

We could have used market instead of marketplace in this essay – originally a market and a marketplace (the physical location where the market took place) were essentially identical. However, over time the concept of a market has been abstracted and we think of markets as the general process of exchange between different parties. ↩

-

The analogy with Uber and others should be clear. ↩

-

it is, in theory, also possible for the buyers (consumers) to club together. But this is relatively rare because it is usually much harder for them to coordinate together compared to sellers because they are more numerous, less organized and each individually has less "skin in the game". Compare, for example taxi drivers with taxi customers (many of whom may not even live in the city where they are taking a ride). ↩

-

If you who have watched the film Trading Places you will have seen this in action when the Duke brothers are bankrupted at the end and informed that their seat on the exchange will be up for auction (it is very valuable). ↩

-

It is, in theory, possible to decentralize the order book. However, for reasons of performance and latency it is probably easiest to centralize it in a one or a few managers. ↩

-

There is an analogy here with telco-regulation where the monopoly telecommunication operator can be thought of as a platform monopolist controlling last-mile access into homes. Regulators required the monopoly operated to provide non-discriminatory access to other service providers such as ISPs at regulated prices (in some cases they went so far as to force a break-up of the monopolist and have the core infrastructure operated by a separate regulated company). Analogously for marketplace platforms you can imagine a regulator requiring the marketplace operator to provide non-discriminatory access to the order book at regulated prices (the order book equates to the last-mile network for telcos). ↩